Thinking of buying a house in Scotland? Whether you’re stepping onto the property ladder or moving home, our comprehensive guide to buying a house in Scotland explains everything you need to know. From understanding Home Reports and setting a budget to navigating the conveyancing process and collecting your keys, we walk you through each stage with clear, practical advice. We’ve also included answers to common questions and a handy checklist to help you stay on track.

In this article

📝 Step 1: Before You Make an Offer – Get Prepared

🔍 Step 2: Finding the Right Property

🧑💼 Step 3: Understanding the Role of Estate Agents

📄 Step 4: Reviewing the Home Report

✉️ Step 6: Missives: The Contract Negotiation

⚖️ Step 7: The Conveyancing Process – What Happens Legally

🏦 Step 8: Paying the Purchase Price for Your House

🔑 Step 9: Completion and Getting the Keys

🗂️ Step 10: After you’ve moved in

Whether you’re buying your very first home, moving up the property ladder, or downsizing, the process of buying a house in Scotland can feel complex. This guide will walk you through each stage, from early financial planning through to getting the keys. We’ll cover legal processes, practical tips, and key milestones to help you feel in control at every step.

📝 Step 1: Before You Make an Offer – Get Prepared

It’s tempting to dive straight into house hunting, but a little groundwork before you start can save a lot of stress later. Buying a home isn’t just about finding the right property—it’s about having your finances in place and understanding the market.

Get Your Mortgage in Order

Unless you’re a cash buyer, you’ll need a mortgage—and it’s best to sort this out before you fall in love with a property. Begin by approaching a mortgage lender or an independent financial adviser. An adviser can look across the whole market and help you find a deal that suits your circumstances, whether you’re employed, self-employed, or have unusual income patterns.

Your goal at this stage is to secure an Agreement in Principle (AIP). This isn’t a binding offer, but it provides a solid indication of how much you can borrow and demonstrates to sellers and estate agents that you’re a serious buyer.

Budgeting Beyond the Deposit

Your budget needs to account for more than just your deposit. Here are the typical costs to factor in:

- Legal fees and outlays – paid to your solicitor for handling the purchase

- Land and Buildings Transaction Tax (LBTT) – Scotland’s property tax, calculated based on the purchase price

- Registration dues – the fee to register your ownership

- Lender fees – some lenders charge a product or arrangement fee

- Valuation or survey fees – if you want a second opinion beyond the Home Report

- Moving costs – vans, removal services, storage, etc.

- Repairs and upgrades – especially where the Home Report flags issues

You should also consider whether you’ll need to offer over the Home Report valuation. If so, can you afford the extra? Lenders usually only lend up to the Home Report value, so you’ll need to fund the difference yourself.

🔍 Step 2: Finding the Right Property

Once your finances are in place, it’s time to search for a property that fits your needs and budget.

Setting Priorities

Think about what really matters to you:

- Is location more important than size?

- Would you prefer a flat in the city or a house with a garden further out?

- Are schools, transport links, or local shops essential?

There are always compromises—what’s important is being clear on your non-negotiables and remaining flexible elsewhere.

Broadening Your Search

Utilise property websites such as Rightmove, Zoopla, and OnTheMarket. Set up alerts and expand your search radius by a few miles—you might find a hidden gem just outside your preferred area.

Don’t forget to check the market trends in your chosen location. Prices can vary dramatically, and knowing what’s typical can help you spot a fair deal.

🧑💼 Step 3: Understanding the Role of Estate Agents

In Scotland, estate agents typically act on behalf of the seller, rather than the buyer. They’re paid to get the best price for their client, so don’t rely on them for impartial advice.

That said, they’re an important point of contact. They’ll:

- Arrange viewings

- Provide the Home Report

- Let your solicitor know if a closing date is set

If you find a house you’re seriously interested in, ask your solicitor to “note interest”. This means the estate agent must let your solicitor know if a closing date is set or another offer is received.

📄 Step 4: Reviewing the Home Report

Every property for sale in Scotland (unless it’s a new build or certain types of private sales) must have a Home Report, which contains:

- A single survey – a detailed condition report, including a valuation

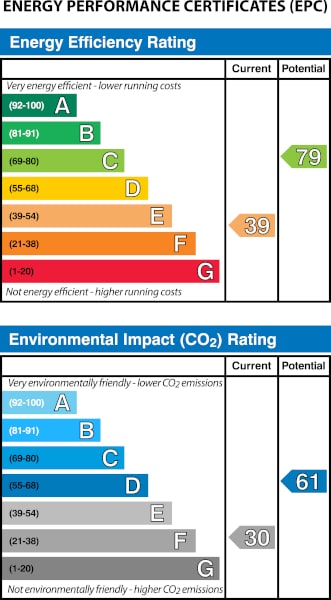

- An Energy Performance Certificate (EPC) – showing energy efficiency

- A property questionnaire – information provided by the seller

The single survey will highlight any issues needing attention—whether urgent or longer-term. Use this to assess whether the property is sound and to plan your future repair budget.

When you attend a viewing, take the Home Report with you and ask the seller to show you areas mentioned as requiring attention.

You should also:

- Ask about boundaries and what’s included in the title

- Clarify which garden or parking areas are private or shared

- Request copies of completion or building warrants for any alterations

And importantly, visit the area at different times of day to get a feel for noise, parking, and general atmosphere.

Check out how much your conveyancing costs will be with our free Conveyancing Calculators. We cover the costs for first-time buyers, home movers, new-build purchases and part-exchange. Check it out now.

💷 Step 5: Making an Offer

Now comes the exciting part—making an offer on your chosen property.

You’ll instruct your solicitor to submit a formal written offer, which typically includes:

- The price you’re offering

- The proposed date of entry (when you’ll get the keys)

- Items to be included in the sale (such as white goods)

- Any specific conditions (e.g. subject to a specialist survey)

Offers can be submitted at any time unless a closing date is set, in which case all interested parties must submit their best and final offer by that deadline.

Anti-Money Laundering Requirements

Before your solicitor can act on your behalf, you’ll need to:

- Prove your identity (passport or driving licence + proof of address)

- Provide evidence of your deposit or funding source

If you’re receiving gifted funds, such as from family, your solicitor must also check the identity and source of funds of the person giving the gift.

These checks are a legal requirement and must be completed promptly to avoid delays.

✉️ Step 6: Missives: The Contract Negotiation

Once your offer is verbally accepted, your solicitor begins formal negotiations with the seller’s solicitor. This is accomplished through a series of letters, known as missives, which collectively form the legal contract for the purchase of the property.

What Are the Scottish Standard Clauses?

Most residential offers in Scotland are based on a standardised template known as the Scottish Standard Clauses (Edition 6). These clauses cover key areas such as:

- The date of entry

- Items to be included in the sale

- Responsibility for repairs or damage

- Access rights and shared maintenance

- Planning permissions and completion certificates

The advantage of the Standard Clauses is that they provide a consistent and widely accepted starting point for negotiation. However, the seller’s solicitor may still issue a qualified acceptance—a formal response that either modifies or adds conditions to your offer.

A Two-Way Negotiation Process

Negotiating missives is rarely a one-step affair. Your solicitor and the seller’s solicitor will often go back and forth, each proposing or amending specific terms until both parties are satisfied with the terms. This may involve clarifying:

- What’s included in the sale (e.g. white goods or garden sheds)

- Who is responsible for repairs noted in the Home Report

- Special conditions (such as sale subject to the buyer obtaining a mortgage)

Once both sides agree to all terms, one solicitor issues a final acceptance. At this point, the missives are said to be concluded, and the contract becomes legally binding.

⚠️ Until missives are concluded, either party can walk away without penalty.

Missives and Conveyancing Run in Parallel

It’s essential to recognise that the conclusion of missives and the conveyancing process often overlap. While solicitors are negotiating the contract terms, they are also:

- ✔ Checking the title

- ✔ Ordering property searches

- ✔ Preparing mortgage documentation

- ✔ Gathering funds and documentation from both parties

This parallel working helps to keep things moving and prevents unnecessary delays.

Why Do Missives Sometimes Take So Long?

There’s a common perception that missives “drag on”—and sometimes they do. Here are some typical reasons for delay:

- Mortgage Offer Not Yet Issued

If you’re waiting on formal mortgage approval, your solicitor will hold off concluding missives until the loan is confirmed. - Outstanding Documentation

Missing paperwork—such as building warrants, guarantees, or title plans—can slow down the process while the seller gathers the necessary documents. - Negotiation Over Conditions

If either party insists on specific clauses or modifications (e.g. additional time to vacate or repair work to be done), extra time may be needed to resolve them. - Chain Dependency

If your purchase is dependent on a sale (or vice versa), delays elsewhere in the chain can have a knock-on effect. - Last-Minute Surprises

Issues identified during title checks or subsequent viewings may necessitate renegotiation or the addition of conditions before proceeding. - Anti-money laundering (AML) checks for gifted deposits

If you are receiving a gift to help with your deposit, your solicitor must carry out AML checks before proceeding.

⚖️ Step 7: The Conveyancing Process – What Happens Legally

Once your offer is verbally accepted, the formal legal process begins. This is known as conveyancing, and it continues until the property is legally transferred into your name.

Checking the Title and Preparing the Transfer

Your solicitor will:

- Examine the title deeds to ensure the seller has good legal ownership

- Check for burdens or restrictions affecting the property

- Obtain reports to ensure there are no adverse planning or legal issues

- Prepare the Disposition—the deed transferring ownership to you

You may be sent a copy of the title plan to confirm the boundaries. Review this carefully and flag up any discrepancies with your solicitor.

If you’re taking out a mortgage, your solicitor will also prepare the Standard Security, which secures the lender’s interest in the property.

⚠️ Common Title Problems in Conveyancing (Scotland)

As part of the conveyancing process, your solicitor will examine the property’s title deeds to ensure your ownership will be sound and unchallengeable. Occasionally, issues arise that need to be resolved before completion. Here are some of the most common title problems encountered in Scottish property transactions:

1. Boundary Discrepancies

The legal title may not match the physical boundaries on site. For example, a fence or driveway might extend beyond the title plan, or part of the garden might not be legally included. This can cause problems if a neighbouring owner disputes ownership or access.

2. Unregistered Title

While most properties in Scotland are now registered with the Land Register, some still have older Sasine titles. These can be harder to interpret, and your solicitor may need to carry out extra work to confirm ownership and boundaries.

3. Missing or Inadequate Rights of Access

If the property relies on a shared path, lane or driveway to access it, the title must grant clear rights of access. Missing or poorly defined access rights can lead to future disputes with neighbours and may even affect mortgage approval.

4. Outstanding Securities or Inhibitions

A property cannot be sold with outstanding legal burdens, such as an unpaid mortgage (known as a Standard Security) or an inhibition (a court order preventing the sale). These must be discharged before completion, and delays can occur if they’re not dealt with early.

5. Undisclosed Title Conditions

Some properties come with title burdens or conditions—such as restrictions on use, maintenance obligations for shared areas, or limitations on alterations. These must be carefully reviewed to ensure they won’t affect your intended use of the property.

6. Unauthorised Alterations

If previous owners have extended or altered the property (e.g., a loft conversion or conservatory) without the necessary permissions or documentation, this could lead to enforcement action or refusal of mortgage funding. Your solicitor will look for completion certificates or planning consents.

7. Communal or Shared Repairs

In flats or tenements, the title often includes shared responsibility for repairs to the roof, stairs, or drains. Your solicitor will review how costs are divided, whether there’s a formal factoring arrangement, and whether any major repairs are pending.

What Happens If a Title Problem Is Found?

Your solicitor will advise you immediately if something unusual or concerning is found in the title. In many cases, the issue can be resolved before completion—through corrective deeds, indemnity insurance, or negotiated solutions with the seller. Occasionally, you may decide to walk away from the transaction if the problem cannot be rectified or poses unacceptable risk.

💷 Step 8: Paying the Purchase Price for Your House

No matter how you are funding your purchase, your solicitor’s job is to ensure that the full price is transferred to the seller’s solicitor on the date of entry. The way this is done depends on how you are paying, whether you are a cash buyer, relying on the proceeds from selling another property, or using a mortgage.

Cash Buyers

If you have the full purchase price available in your bank account or investments, you are considered a cash buyer. This means no mortgage is involved, and there is no need for a Standard Security or lender approval. This can often make you a more attractive buyer, as the transaction may be more straightforward and quicker.

However, being a cash buyer does not mean avoiding all checks and timescales. You will still need:

- Anti-money laundering verification of your identity and the source of your funds

- To transfer the full purchase price to your solicitor in good time for settlement

- To allow your solicitor to carry out all the usual title and property checks

Cash buyers sometimes complete more quickly than buyers relying on finance, but the legal work must still be done thoroughly.

Buyers Funding the Purchase from the Sale of Their Current Home

This is sometimes mistakenly called being a cash buyer, but it is not the same thing. If you are funding your purchase from the proceeds of your sale, you won’t have the cash in hand until your sale completes.

This means:

- Your solicitor must carefully coordinate both transactions

- Your purchase is dependent on your sale completing on time

- Any delays in your sale can delay your purchase, which is why both are often scheduled for the same date of entry

In this scenario, the sale proceeds are received into your solicitor’s client account and then immediately used, along with any other funds you need to provide, to pay for your purchase.

What Happens If You're Taking Out a Mortgage

If you’re using a mortgage to fund part of your purchase—as many buyers do—there are a few essential legal steps your solicitor must complete before the purchase can go ahead.

Your Mortgage Offer

Once you’ve had an offer accepted on a property, your mortgage lender will need to issue a formal mortgage offer. This confirms the amount they will lend, the interest rate, the term of the loan, the repayment type, and any conditions that must be met.

Make sure you:

- Check the offer carefully

- Confirm the loan matches your expectations

- Flag any special conditions to your solicitor straight away

Your solicitor won’t be able to conclude missives until your mortgage offer is in place, so it’s essential to progress this promptly.

Standard Security – Securing the Lender's Interest

To protect their interest in the property, your lender will require a legal document known as a Standard Security. This gives them the right to repossess and sell the property if you don’t meet the terms of your mortgage.

Your solicitor will:

- Prepare the Standard Security document

- Explain its effect

- Ask you to sign it in advance of completion

This document is then submitted to the Registers of Scotland along with the Disposition (the deed that transfers ownership to you).

What Your Solicitor Does

Once the mortgage offer is in place, your solicitor’s role goes beyond simply shuffling paperwork. They will liaise directly with your lender to ensure all lending conditions are met, confirm the property is acceptable to the lender, and handle any legal queries the lender’s underwriters might have.

They will also ensure that:

- All title checks satisfy your lender’s requirements

- Any issues that could affect the lender’s security are resolved

- The lender’s funds are requested (“drawn down”) in time for settlement

- Your deposit and the mortgage funds together make up the full purchase price

This careful co-ordination is essential to avoid last-minute funding problems on the date of entry.

What You Need to Do

Your role in the mortgage process is equally important. You will need to respond promptly to your lender’s and solicitor’s requests to avoid delays. This includes signing mortgage documents, providing proof of identity and funds, and making sure your deposit and any other costs are transferred to your solicitor well before settlement day.

You should also keep your solicitor and lender informed if anything changes in your financial situation between the mortgage offer being issued and the date of entry, as this could affect your eligibility for the loan.

🔑 Step 9: Completion and Getting the Keys

The date of entry is the day you legally take ownership of the property and get your keys.

Before this:

- Your solicitor will request your deposit and any other sums due (LBTT, legal fees, registration dues, etc.)

- They will also draw down mortgage funds from your lender

On the day itself:

- Your solicitor sends the full purchase price to the seller’s solicitor

- In exchange, they receive the signed Disposition and authorise key release

- You collect your keys and can move in!

🗂️ Step 10: After you've moved in

After you’ve moved in, your solicitor’s work isn’t quite done.

They will:

- Pay your LBTT to Revenue Scotland

- Register the Disposition and Standard Security (if you’ve bought with a mortgage) with the Registers of Scotland

- Provide a final account showing all monies received and paid out

- Once your title has been registered in the Land Register, they will send you a copy (for new-build properties, this can take some time after the registration)

Once the Disposition in your favour has been sent to the Land Register for registration, you become the legal owner of the property.

Unfortunately, sometimes there are problems once you’ve moved into the property. To find out what to do you should read our article on Problems after buying a house – what are your rights?

Thinking of Buying a House?

Whether you’re a first-time buyer or a seasoned homeowner, the process can be daunting. But with the right advice and guidance, buying a house in Scotland can be a straightforward and rewarding experience.

If you’re thinking of buying, speak to our experienced conveyancing team. We’ll guide you through every step and make sure everything goes smoothly from start to finish.

❓ Frequently Asked Questions: Buying a House in Scotland

1. How long does it take to buy a house in Scotland?

Most purchases are completed within 6 to 12 weeks after an offer is accepted. However, timescales can vary depending on mortgage approvals, title issues, or delays in finalising missives.

2. Can I pull out after my offer is accepted?

Yes—but only if missives have not been concluded. Once the missives are complete, the contract is legally binding and backing out could have financial consequences.

3. What's a closing date?

The seller sets a closing date when there are multiple interested parties. All offers must be submitted to the selling agent by the specified date and time, typically in sealed bids.

4. Do I need a survey in addition to the Home Report?

The Home Report includes a valuation and condition report. However, for older or unusual properties, you may choose to commission an independent structural survey.

5. What is LBTT, and how is it calculated?

Land and Buildings Transaction Tax is payable on property purchases over £145,000 (or £175,000 for first-time buyers). It’s calculated in bands, like income tax. Online calculators are available on the Revenue Scotland website.

6. What happens if I'm getting help with my deposit?

If someone (like a parent) is gifting you money, your solicitor will need to carry out checks on them too and may require a formal declaration that it is a gift, not a loan.

7. When do I get the keys to the property?

On the date of entry, after your solicitor has sent the funds to the seller’s solicitor and received confirmation of key release. You’ll usually collect them from the estate agent.

8. Can I make an offer directly to the estate agent?

No. All formal offers must be submitted through a solicitor and must be in writing. Informal negotiations or verbal offers have no legal standing.

9. Is it possible to buy and sell at the same time?

Yes, but it requires careful coordination. Many people make their purchase conditional on the sale of their existing home.

10. What's the difference between "noting interest" and an actual offer?

“Noting interest” is a way for your solicitor to indicate you’re considering making an offer. It keeps you informed if a closing date is set. It’s not a commitment to buy.

📋 Practical House Buying Checklist (Scotland)

- Use this checklist to stay organised throughout the home-buying process. It’s broken into clear stages with key actions and milestones.

🏁 Before You Start

- ✅ Get mortgage advice and secure an Agreement in Principle

- ✅ Calculate total budget (deposit + fees + taxes)

- ✅ Check LBTT liability

- ✅ Factor in repair costs and potential offers over valuation

- ✅ Choose a solicitor and notify them you’re house hunting

🔍 While House Hunting

- ✅ Set your search criteria and be flexible

- ✅ Register with estate agents and set up alerts on property portals

- ✅ View multiple properties and compare Home Reports

- ✅ Research recent sale prices via ScotLIS or property portals

- ✅ Visit neighbourhoods at different times of day

📝 Ready to Make an Offer

-

✅ Ask your solicitor to “note interest”

-

✅ Collect your ID and proof of funds for anti-money laundering checks

-

✅ Confirm your offer price, date of entry, and items to include

-

✅ Instruct solicitor to submit a formal written offer

-

✅ Prepare for potential negotiation or closing date

📑 After the Offer is Accepted

- ✅ Respond promptly to solicitor regarding conditions in missives

- ✅ Review and agree to adjustments in contract terms

- ✅ Ensure gifted deposits (if any) are documented and approved

- ✅ Consider commissioning additional surveys if needed

- ✅ Sign Standard Security if you’re using a mortgage

💷 Getting Ready for Completion

- ✅ Transfer deposit and funds for LBTT, registration and legal fees to solicitor

- ✅ Confirm key collection arrangements

- ✅ Notify utility providers, insurers and council of your move-in date

- ✅ Book removals and begin packing

- ✅ Finalise details with mortgage lender and solicitor

🔑 On Date of Entry

- ✅ Your solicitor completes the funds transfer

- ✅ Disposition is delivered and keys are released

- ✅ Pick up keys from the estate agent or the seller’s solicitor

- ✅ Begin move-in!

📄 After You Move In

- ✅ Receive solicitor’s final account

- ✅ Receive registered title from Registers of Scotland

- ✅ Store your paperwork safely (Dispositions, title, mortgage docs)

- ✅ Notify banks, employer, DVLA and others of your change of address

- ✅ Celebrate your new home! 🎉